fsa health care limit 2021

Get a Free Health Insurance Quote in 3 Easy Steps. You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription drugs doctors office co-pays and more.

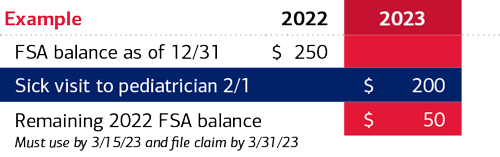

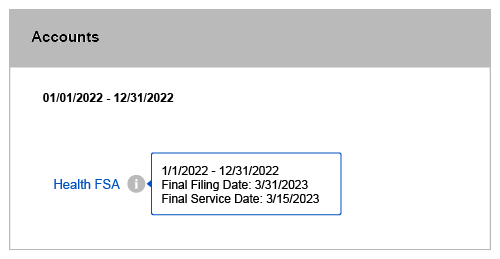

Understanding The Year End Spending Rules For Your Health Account

5000 2020 2021 2022 2500 2020 2021 2022 Health Care.

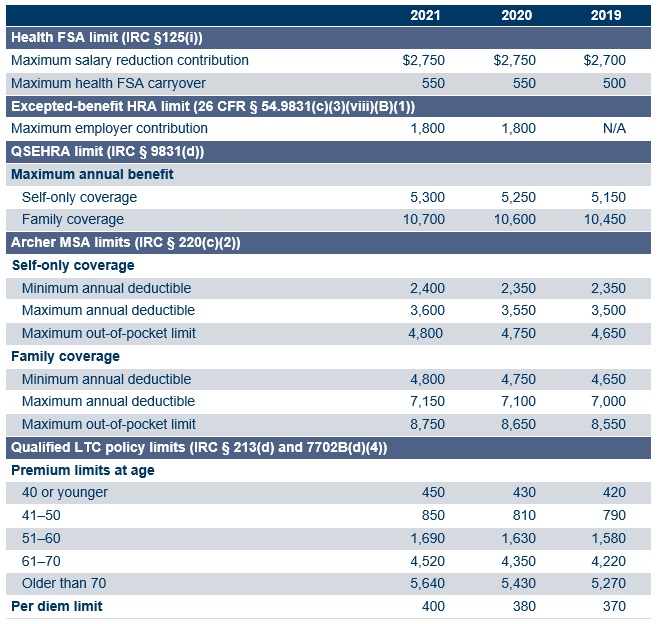

. 2020-45 keeps the limit at 550 for 2021 health FSA carryovers to the. As a result the maximum Health Care FSA rollover limit of 550 will remain unchanged for plans that begin or renew on or after January 1 2021. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

The health FSA contribution limit will remain at 2750 for 2021. Keep in mind the following. The allowable amount of carry-over for FSA plans that have adopted a carry-over provision has been increased to 550 effective for.

Each spouse in the household may contribute up to the limit. However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to be carried over into plan year 2022. For 2022 the contribution limit is 2750.

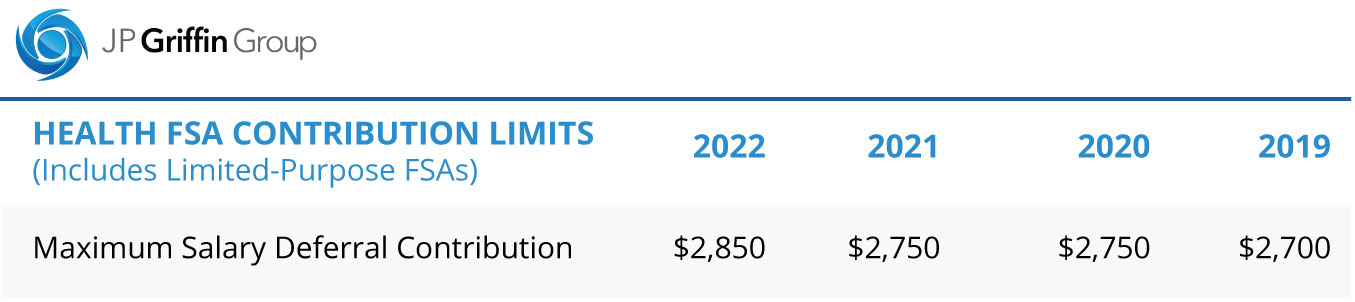

The annual contribution limit for your health care flexible spending accounts health FSAs is on the rise for 2022 according to the Society for Human Resource Management. ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only. The minimum annual election for each FSA remains unchanged at 100.

On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden. On Monday October 26 2020 the Internal Revenue Service IRS released Revenue Procedure 2020-45 which officially maintained the maximum Health Flexible Spending Account FSA contribution limit at 2750 for calendar year 2021. This is an increase of 100 from the 2021 contribution limits.

Enroll Now While You Can. Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. Health Flexible Spending Arrangements FSAs limitation.

Notice 2021-15 provides flexibility for employers in the following areas related to health FSAs and dependent care assistance programs. Most notably this included a projection of no changes to the 2021 Health Care FSA Limit for a continued annual maximum of 2750 per plan year. Dependent care FSA increase to 10500 annual limit for 2021.

The limiting age remains at 14 for the 2021 plan year but this relief only applies to dependent care fsa funds that remained unspent at the end of the 2020 plan year. The most you can contribute pre-tax to your account is 2750 in 2021 which is unchanged from 2020. 2020-43 set the 2021 employer contribution limit for excepted-benefit HRAs while Notice 2020-33 increased the health FSA limit on 2020 carryovers to the 2021 plan year with future carryovers capped at 20 of the maximum employee pretax contribution to a health FSA for a plan year.

Health Care FSA. If you would like to increase your 2022 contribution amount to the new allowed limit you must email the Benefits Service Center at benefitsjhuedu no later than Dec. On October 26 2020 the Internal Revenue Service IRS released Revenue Procedure 2020-45 which maintains the health flexible spending account FSA salary reduction contribution limit from 2020 which is 2750 for plan years beginning in 2021.

This means youll save an amount equal to the taxes you would have paid on the money you set aside. Employees can now contribute 2850 to their FSA which is. Though flexible spending account funds typically need to be spent by Dec.

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. Child Elderly Dependent Care. Employees in 2021 can again put up to 2750 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. This amount is listed in Revenue Procedure 2020-45 section 317 available at IRSgovpubirs-droprp-20-45. Get Your Free Quote Today.

But employers may offer either a grace period or a carryover but not both to health FSA participants under certain circumstances. The limit is per person. Salary reduction contributions to your health FSA for 2021 are limited to 2750 a year.

You dont pay taxes on this money. 31 many workers have an additional 12 months to use their 2021 contributions to cover qualifying medical. The 2022 limits as compared to the 2021 limits are outlined below.

Beginning January 1 2022 Health FSA contributions are limited by the IRS to 2850 each year this is a 100 increase from 2021 limit of 2750. 2021-R-0054 February 11 2021 Page 3 of 4 unused health and dependent care FSA funds are forfeited at the end of the plan year known as the use it or lose it rule IRS Notice 2005-42. IRS Maintains Health FSA Contribution Limit for 2021 Adjusts Other Benefit Limits.

Child Elderly Care FSA. This carryover limit is only for the HCFSA or LEXHCFSA and not allowed for the dependent care flexible spending account DCFSA. Provides flexibility to extend the permissible period for incurring claims for plan years ending in 2020 and 2021.

The IRS recently announced that the 2022 limit for health care and limited purpose flexible spending accounts or FSAs is 2850 up from 2750 in 2021. Provides flexibility to adopt. Total contributions for both the employer and employee cannot exceed 5000 for Dependent Care.

For spouses filing jointly each spouse can elect up to the health care max in the year in 2022 that would be 2850 2850 5700 household total. For married couples filing joint tax. The HCFSALEXHCFSA carryover limit is 20 percent of the annual contribution limit.

Provides flexibility for the carryover of unused amounts from the 2020 and 2021 plan years. It remains at 5000 per household or 2500 if married filing separately. Ad Top Health Insurance Plans From Trusted Carriers.

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Hsa Vs Fsa See How You Ll Save With Each Wex Inc

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Best Deals And Coupons For Fsa Store Baby Health Health Fitness Diet

Understanding The Year End Spending Rules For Your Health Account

Hra Vs Fsa See The Benefits Of Each Wex Inc

What Is An Fsa Definition Eligible Expenses More

Fsa Vs Hsa Vs Hra Which One Is Better Odyssey Advisors Inc

Fsa Contribution Limits 2021 Personal Budget Health Savings Account Personal Finance Advice

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Fsa Limit Lawley Insurance

Understanding The Year End Spending Rules For Your Health Account

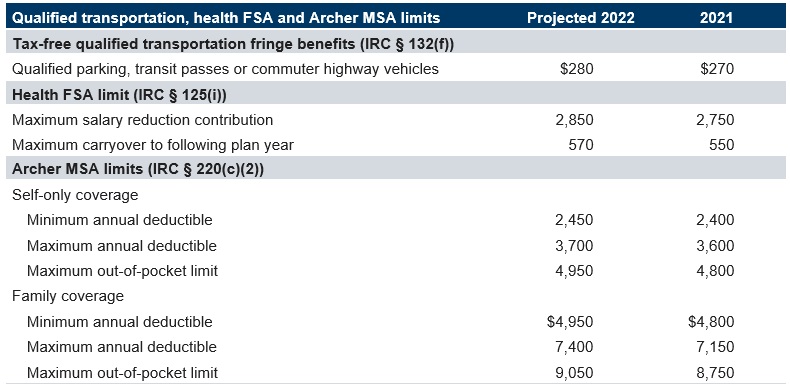

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Fsa Eligible Items Top Tips And What You Can Purchase At A Glance

Learn About The Process And Limits To Your Flexible Spending Account Fsa Contributions Vision Insurance Contribution Lasik Surgery